Insight: Reddit’s reaction to the $12.5billion Treasury buyback reveals a high-noise, low-signal discourse dominated by filler language rather than economic understanding.

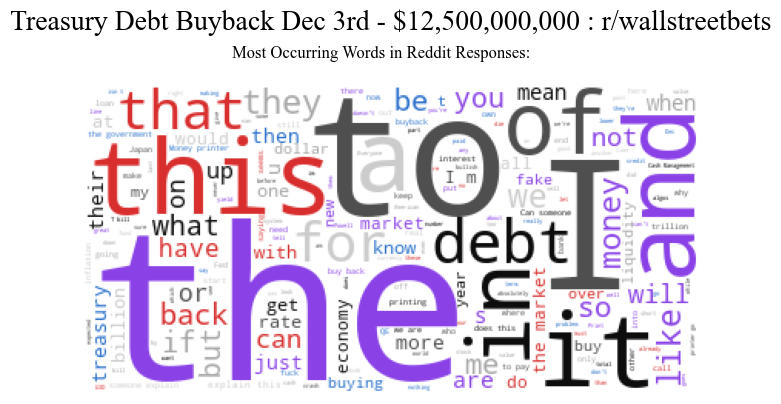

I saw a r/WallStreetBets post about the treasury buyback, and decided it could be valuable to analyze the language used in the comments to see if any meaningful insight could be extracted; what I found was a clear lack of understanding of the economic event being discussed.

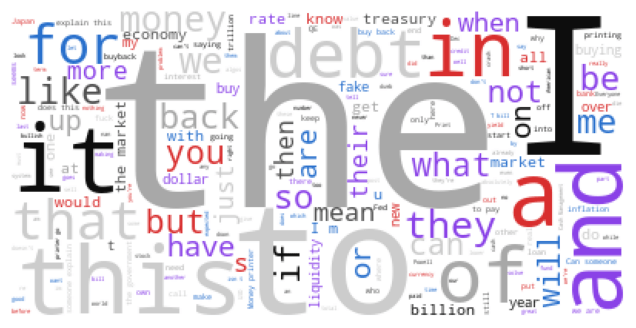

The most dominant words used were filler and function words. Words such as “the”, “this”, “to”, “that”, “of”, and similar. These words typically appear when people are not describing facts, explaining concepts, or articulating structured thought. Instead, they show up when people react emotionally, speak in fragments, or lack the vocabulary and conceptual grounding needed to discuss the topic coherently.

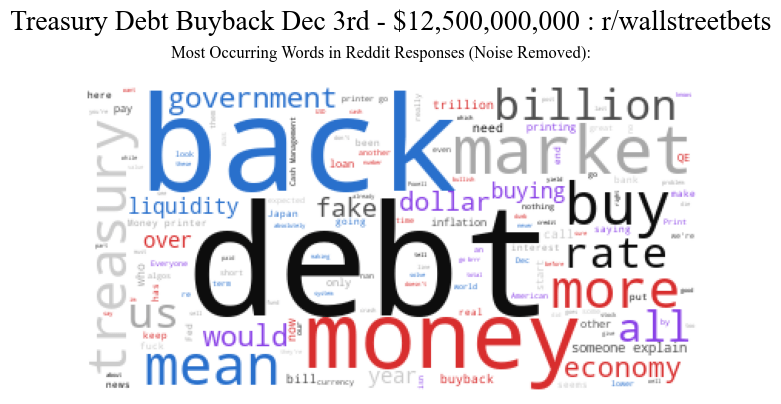

Once I removed the noise, only basic economic terms remained:“treasury”, “economy”, “money”, “debt”, and the like. This terminology points to people generally not reading past headlines, or genuinely engaging with the substance of the conversation.

The insight I gathered from this wasn’t exactly what I expected, but it is valuable nonetheless. Based on the linguistic patterns alone, r/WallStreetBets is not a reliable place to learn anything about economics. The discourse is high in volume but low in informational content revealing more about crowd psychology than about the financial event.

What looks like market commentary is actually crowd psychology: reactive, emotionally loaded, and informationally shallow.